Consumer Proposals

Learn how consumer proposals work, the long-term consequences, and what debts can be included.

Important Info on Consumer Proposals in Canada

Filing, Credit, Bankruptcy, Debt Relief Options & What to Watch Out For

One option to consolidate your debts that isn’t a debt consolidation loan is to file a consumer proposal. Under the Bankruptcy and Insolvency Act, a consumer proposal is a legal process and a matter of public record between you and your creditors to pay back part of what you owe.

The amount you repay is largely based on your income and what you own. However, it can typically decrease how much debt you have to repay your creditors by a significant amount.

When you file a consumer proposal, unlike a debt consolidation loan, it is a legally binding agreement that can only be put together and administered by a licensed bankruptcy trustee and costs around $1,500 to file.

You’ll pay an initial setup fee, and if it’s accepted by your creditors and approved by the courts, you’ll have to pay the balance to move forward, most likely in the form of monthly payments. Also, unlike some other debt-relief options, there is a consumer proposal cost.

In addition to this, the licensed insolvency trustee will take 20% of your future payments as a fee for overseeing and managing your consumer proposal. To be legally binding, the creditors who own the majority of your debt must agree to the proposal. Once they do, you repay the agreed amount over a maximum term of 5 years, and a permanent public record is placed in a searchable online database.

Beware the Big Debt Rip-Off

Promoting consumer proposals as a quick and easy way to get out of debt has become a common way for many companies and sales people to take advantage of vulnerable, unsuspecting consumers.

Don’t let this happen to you! There are a number of problems with the way consumer proposals are being promoted. They’re being sugar coated and sold as a new government debt relief program. However, the truth is that proposals aren’t a new government program. They’ve been around for over 30 years, and they often don’t work as advertised for a whole lot of people.

Another huge problem is that only a licensed bankruptcy trustee is legally allowed to file paperwork for a consumer proposal, but a lot of debt relief companies and debt consultants will charge you thousands in fees for a service they know they are not allowed to provide only to then refer you to a bankruptcy trustee who then charges his or her own fees. Don’t get ripped-off. Don’t pay thousands for a referral that should be free.

How to Keep from Getting Ripped Off

Follow the three tips below and start by speaking with a member of Credit Counselling Canada. This organization is an association of non-profit credit counselling agencies that do not work on commission. If a consumer proposal is truly one of your best options, one of their agencies can let you know and refer you to a reputable bankruptcy trustee for free.

Talk With a Non-Profit Credit Counsellor

Speak with a non-profit credit counsellor about your financial situation first. They will be able to review your situation with you and help you explore and understand all your options to deal with your debt.

Only Pay a Trustee for Consumer Proposal Services

Never pay money to anyone for consumer proposal services except a licensed bankruptcy trustee. By law, only a licensed trustee is permitted to do the work and charge for consumer proposals.

Watch Out for Commission-Based Debt Consultants

Ask how the person helping you is compensated. Many people who will seek to advise you on your debts work on commission. Make sure the “solution” they suggest is in your best interest – not theirs.

Discover Your Options

A Visual Overview of Possible Options

Here are some options that may be available to you based on the information you have provided about your financial situation. The most likely options are in green, less likely in yellow, and least likely in red. This is only intended to provide you with a general idea of the options that may be available to you. A credit counsellor will need to go over your information in much more detail to make a more precise determination.0

Option

Do a Deeper Dive to Uncover More Options

It looks as though your situation requires more in-depth analysis from a trained credit counsellor. They can help you optimize your budget, explore options, and create a plan to get back on track.

0

Option

Self-Managed Solution

After thoroughly exploring your options with a credit counsellor, they can help you put together a plan to get out of debt in a reasonable amount of time. You can then implement this plan on your own.

0

Option

Debt Consolidation Loan

Based on the information you've provided, it appears as though this could be a possibility if your credit score is strong enough.

0

Option

![]()

Debt Management Program

It appears as though this may be an option for you. A Debt Management Program eliminates or drastically reduces interest and consolidates all payments into one.

0

Option

![]()

Consumer Proposal

This may be an option for you to consider. It's a legal process that consolidates all payments into one. Talk to a credit counsellor about this and see if it makes sense for your situation.

0

Option

Bankruptcy

Based on the information you've entered, it appears as though bankruptcy may be an option to resolve your financial challenges. You should speak with a credit counsellor about this and make sure you've exhausted all other options first.

0

Option

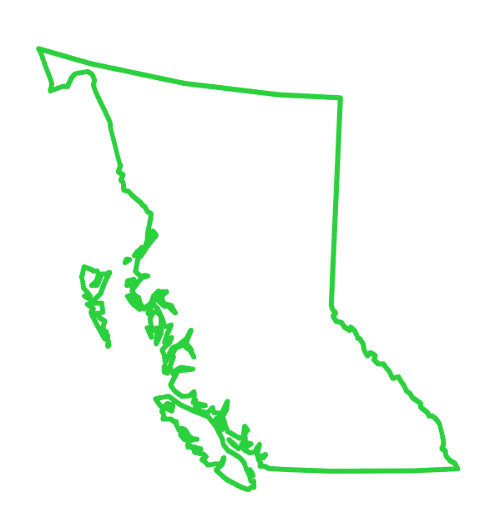

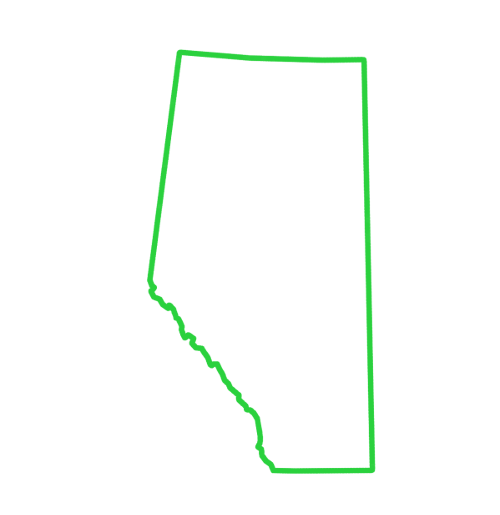

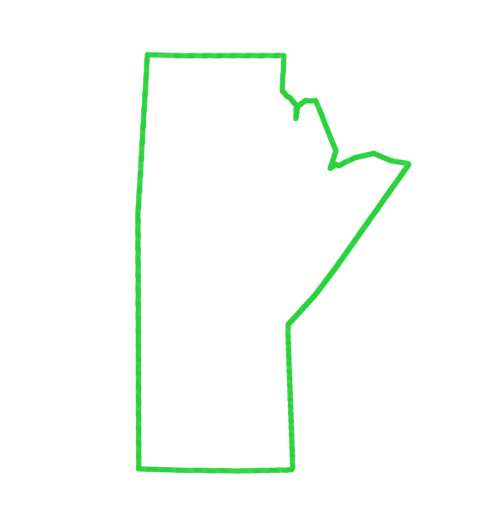

Orderly Payment of Debts

Based on what you've entered, it looks as though an Orderly Payment of Debts (OPD) program may be an option for you. To find out if this would make sense for your situation, you should speak with a credit counsellor.

0

Option

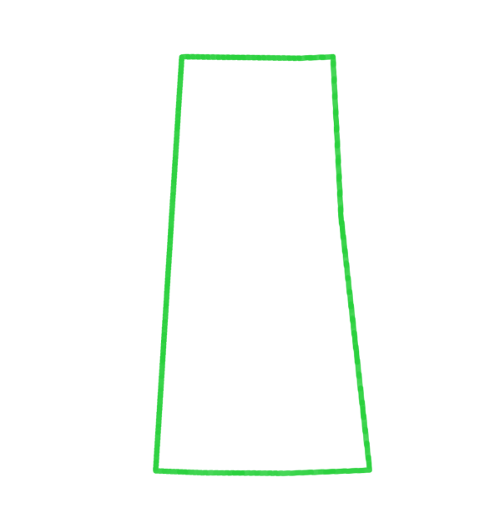

Voluntary Deposit

Based on the information you've provided, it looks as though a voluntary deposit program may be an option to address your debt situation.

0

Bonus Option

Online Workshops

Learn how to improve your financial situation, create a budget, make your dollars stretch further, and get out of debt with one of our many helpful online workshops we call webinars.

More Specifics on How We Can Help You

Get Help Today

Give us a call to speak with one of our credit counsellors at 1-888-527-8999, or if you'd like us to contact you instead, please fill out the form below.What’s a Consumer Proposal?

Will It Affect My Credit?

A consumer proposal is a legal arrangement and is a matter of public record. It’s also noted on someone’s credit report and is there for another three years after the proposal has been successfully completed.

How a consumer proposal affects credit will depend on what else is on someone’s credit report. Learn more about what a consumer proposal is and how it works.

Frequently Asked Consumer Proposal Questions

What Happens When You Miss Payments? - Consumer Proposal Defaults

A proposal has strict conditions. If someone misses 3 payments, the consumer proposal defaults, and they cannot file it again. Creditors will then proceed with collecting on what is still owed. This can include legal action.

What Debts Are Eligible for a Consumer Proposal? - How Student Loans Are Affected

Not all debts can be included in a consumer proposal. Student loans often can’t be included, especially if it has been less than 7 years from when someone stopped studying.

While someone is making payments on their consumer proposal, student loan payments aren’t required. However, interest is still added to the student loan during that time.

At the end of the proposal, someone may owe more on their student loan than they did before they filed the consumer proposal. In that case, it’s better to seek another debt repayment program.

What Happens With Secured Debts and Assets?

Secured debts, like a car loan, also can’t be included in a proposal. Unsecured debts may be able to be inlucded. Assets tied to secured loans may need to be sold when someone enters into a consumer proposal because someone isn’t able to manage the payments any longer. Other times, creditors won’t agree to a proposal if someone has assets they can sell to pay back the full amount of what they owe.

Will Creditors Accept My Consumer Proposal?

There is no guarantee creditors will accept your Consumer Proposal. Each creditor has their own policies and each will consider someone’s overall circumstances carefully. For instance, if someone has a lot of surplus income over and above the Superintendent of Bankruptcy’s monthly expense guidelines, creditors will expect them to be able to repay more of what they owe.

What Happens If I Default on Consumer Proposal Payments?

You can’t file another consumer proposal and may need to declare bankruptcy

Having your creditors or a licensed insolvency trustee accept your proposal after you file a consumer proposal is only the first step towards resolving your financial difficulties. Many people who enter into a consumer proposal have so much difficulty keeping up with monthly payments that their proposal collapses. Once that happens, they’re left in limbo being unable to file another proposal and having to consider other options, including bankruptcy.

Debt Consolidation Options

A Consumer Proposal Is One of Many

You may not need to file for a consumer proposal. Explore other options that are available to you

Just like with other debt consolidation options, a consumer proposal is a good fit for some people, but not for everyone. It depends on a number of things including if someone is working, the type of debts they have, how much they owe and their overall financial situation.

Contact Us for More Information About Consumer Proposals

To help you figure out if filling a consumer proposal is the best option for you, contact us to find out about all of your debt consolidation options. One of our counsellors will be happy to look over your whole financial situation carefully and answer your questions. Speaking with our certified Counsellors is always free, confidential and without obligation.

Related Topics

Getting Rid of Debt

We’re happy to help you figure out your options. There are more than you might think.

Insolvency Options

Canada has 2 insolvency options, a consumer proposal or bankruptcy. Find out how they stack up.

Credit Counselling

Are you curious about what credit counselling is or how it works? Here’s what you need to know.

Was this page helpful?

Thanks for letting us know.