Debt Consolidation in the Lower Mainland, BC

Objective Non-Profit Options & Advice Beyond What Most Consolidation Companies Offer

Have you been turned down for a debt consolidation loan in Lower Mainland by the banks or consolidation companies you’ve talked to? Is keeping up with your bills a challenge each month? Don’t allow stress and constant worry to wear you down. We’re here to help.

We’ll Work with You to Find the Right Option – Solutions for Problems with Debt Consolidation Loans, Bad Credit, or Credit Cards

One of our highly trained, professionally accredited counsellors can lay out all of your options for you and help you find the right solution that will work out best for your situation—regardless of whether maxed out credit cards, bad credit or other problems have held you back from obtaining a debt consolidation loan. As a non-profit service, we don’t push any particular solution. Instead, all of our debt consolidation advice is centered around your needs and the options that will work best for your financial situation.

We Can Help You Get Your Finances Back on Track, Save Money and Pay Off Debt

Our counsellors can assist you right now by helping you put together a plan to:

- Figure out all your debt consolidation options and decide which will work best for you

- Consolidate your debt payments into one payment you can afford

- Save thousands in interest payments

- Create a spending plan and effectively manage your bills and regular living expenses

Discover Your Options

A Visual Overview of Possible Options

Here are some options that may be available to you based on the information you have provided about your financial situation. The most likely options are in green, less likely in yellow, and least likely in red. This is only intended to provide you with a general idea of the options that may be available to you. A credit counsellor will need to go over your information in much more detail to make a more precise determination.0

Option

Do a Deeper Dive to Uncover More Options

It looks as though your situation requires more in-depth analysis from a trained credit counsellor. They can help you optimize your budget, explore options, and create a plan to get back on track.

0

Option

Self-Managed Solution

After thoroughly exploring your options with a credit counsellor, they can help you put together a plan to get out of debt in a reasonable amount of time. You can then implement this plan on your own.

0

Option

Debt Consolidation Loan

Based on the information you've provided, it appears as though this could be a possibility if your credit score is strong enough.

0

Option

![]()

Debt Management Program

It appears as though this may be an option for you. A Debt Management Program eliminates or drastically reduces interest and consolidates all payments into one.

0

Option

![]()

Consumer Proposal

This may be an option for you to consider. It's a legal process that consolidates all payments into one. Talk to a credit counsellor about this and see if it makes sense for your situation.

0

Option

Bankruptcy

Based on the information you've entered, it appears as though bankruptcy may be an option to resolve your financial challenges. You should speak with a credit counsellor about this and make sure you've exhausted all other options first.

0

Option

Orderly Payment of Debts

Based on what you've entered, it looks as though an Orderly Payment of Debts (OPD) program may be an option for you. To find out if this would make sense for your situation, you should speak with a credit counsellor.

0

Option

Voluntary Deposit

Based on the information you've provided, it looks as though a voluntary deposit program may be an option to address your debt situation.

0

Bonus Option

Online Workshops

Learn how to improve your financial situation, create a budget, make your dollars stretch further, and get out of debt with one of our many helpful online workshops we call webinars.

More Specifics on How We Can Help You

Get Help Today

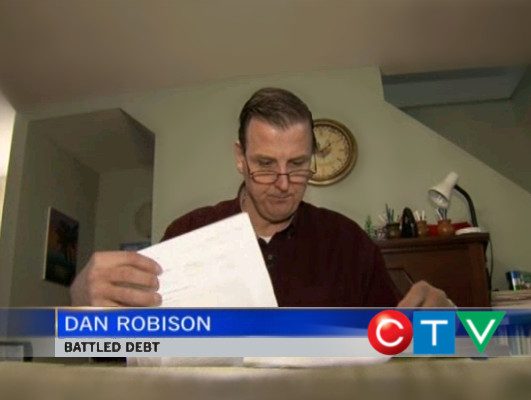

Give us a call to speak with one of our credit counsellors at 1-888-527-8999, or if you'd like us to contact you instead, please fill out the form below.CTV News and Global TV Interviewing People We Helped

On occasion, the news media will talk to one or two of the people we helped who are comfortable sharing their story with the public. Below are three of these stories.

See even more examples of the Credit Counselling Society appearing in the local and national news.

Offering the Best Not for Profit Consumer Debt Consolidation Programs & Interest Relief Plans to Lower Mainland

The Credit Counselling Society has been helping consumers consolidate their debt payments through our non-profit debt management program and through professional, objective advice since 1996. We are accredited by the Better Business Bureau and have won over 80 awards for our outstanding service and exceptionally high standards.

Our commitment to providing the best credit counselling and debt relief service has resulted in 98% of our clients reporting that they would recommend our services to others.

To learn more, don’t hesitate to call us and schedule an appointment to talk with a counsellor. Appointments are free, confidential, and non-judgmental. Call us today at 604-527-8999 or 1-888-527-8999.

There’s a Way Out of Debt with Help

“I had just come to the point where I had given up hope – that there’s no way I could ever repay my debt. A friend of mine suggested I reach out, and I thought I’d get some condescending person on the phone lecture me about money, but my counsellor was the most compassionate, caring person who became sort of my own personal cheerleader.”

– Charis

Find Out More About the Debt Consolidation Options that May Be Available to You

If you’re not prepared to speak with anyone yet about your situation, we have more resources you can use to look into all available debt consolidation loan options on your own.

When you are ready to talk with someone about your consolidated credit and repayment options in Lower Mainland, you can speak with us by phone, email, online chat, or in person at one of our local offices.

We also help people when they feel that bankruptcy is their only option. Our debt counsellors guide people through all relevant information and explore all alternatives to filing bankruptcy in Lower Mainland, BC so that insolvency can be avoided if possible.

Placing Your Interests First

Our highest goal is to always put you first and look out for your best interests in all we do. One of the ways we do this is through accountability and transparency. Our organization and its staff are held to the most rigorous standards of accountability in our industry.