Debt Management Programs & Solutions

Debt Repayment Plans

We help tens of thousands of Canadian consumers each year manage their money and debt better by providing:

- Free, confidential credit and debt counselling

- Budgeting assistance

- Information and referral services

- Money management education (part of these services include workshops and webinars & our educational website)

- Debt Repayment Programs

Our Credit Counsellors are experienced, professionally trained and really care about helping our clients find the right solutions to their debt problems.

Over the years, our clients have repaid over $300 million in debt. They’ve saved thousands of dollars in interest and rebuilt their credit ratings sooner than if they’d tried to repay their debts on their own. We continually work hard to earn the trust of our clients and to be the best Canadian credit and debt counselling service.

See how our Credit Counsellors help people and assist them with their debt problems.

If you are having trouble with your debts, we understand how hard it can be to ask for help. Give us a call and find out how much better you’ll feel once you know what to do about your situation.

Free Consumer Credit Counselling

Money Management & How to Budget

When you speak with one of our Counsellors, they will gather information from you about your debts, your spending and your overall situation. Once they have a good understanding about your circumstances, they will provide you with an objective assessment of what you can do to deal with your situation.

Your Counsellor will:

- provide you with information

- answer your questions

- explain your options

- help you get started with a realistic budget

- ensure that you have enough information to make a good decision about what to do next

All of our information and educational material is provided at no cost to you and our consumer credit counselling services are completely confidential and our counselling sessions are free of charge.

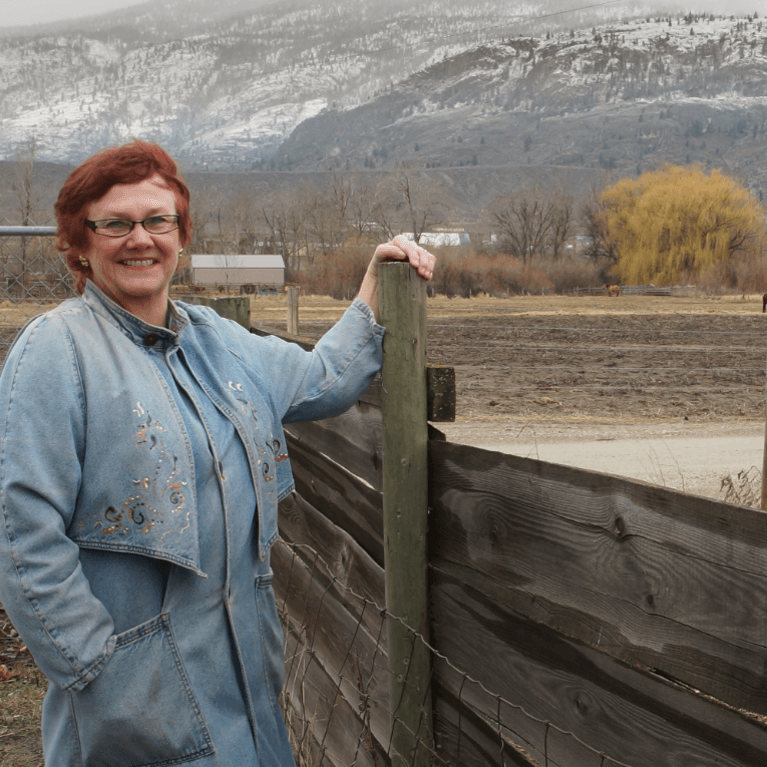

There’s a way out of debt with help

I had just come to the point where I had given up hope, that there’s no way I could ever repay my debt. A friend of mine suggested I reach out, and I thought I’d get some condescending person on the phone lecture me about money, but my counsellor was the most compassionate caring person who became sort of my own personal cheerleader.

Charis

Wondering What to Expect?

If you are nervous about calling us and talking to someone about your situation, watch this short video.

We’re Here to Help You

Related Articles

Client Reviews

Directly from our clients, read and hear about their experiences with CCS.

Our Qualifications

Our counsellors are friendly, professional, and among the highest qualified in our industry.

Credit Counselling

Are you curious about what credit counselling is or how it works? Here’s what you need to know.