Bankruptcy Information for Canada

Alternatives, Credit, Debt Help, Law, Process and Types

Useful information about declaring personal bankruptcy in Canada. Learn about the rules, laws, regulations, how to file, how bankruptcy affects credit, what happens to debts and more.

Declaring personal bankruptcy is the first thing many Canadians think of when they find themselves facing financial difficulty. However, bankruptcy is a big decision and one which will affect your credit for a number of years. There are a lot of alternatives to bankruptcy that many people don’t think of right away, like a consumer proposal, debt settlement, debt consolidation and a debt management program to name a few.

While going bankrupt is a good decision for some people, it’s not usually anyone’s best first option when dealing with insolvency or debts. Two things to note are that there are costs associated when you apply for bankruptcy and your bankruptcy filing will become public record. It is in your best interest to be well informed before you make a serious decision about your financial future.

Types of Debts – What Bankruptcy Won’t Do For You

There’s a lot that people don’t tell you about bankruptcy. Sure, it will get rid of most of your debts, but there are some debts you might still have to pay because they can’t be included in your bankruptcy.

3 common kinds of debt that are excluded from bankruptcy are:

- Secured debts, like a car loan or mortgage

- Student loans, if they are less than 7 years old

- Child and alimony support payments that aren’t up to date

Also, if you recently racked up credit card bills and now want to go bankrupt, creditors may stop you or ask that you pay more, before they let you get rid of the debt through bankruptcy.

The Bankruptcy Process – Working with Your Trustee to Obtain Your Discharge

Those who have gone bankrupt might not tell you that it takes a minimum of 9 months to complete the bankruptcy process. There are costs and fees to go bankrupt, which you pay to your trustee, as well as bankruptcy counselling sessions you must attend. Depending on your circumstances, you may also need to pay extra to your creditors, which delays completing the process and obtaining your discharge. Not everyone loses their home and assets when they file for bankruptcy, but assets above what you’re allowed to keep in Canada will be sold by your trustee.

You should also be aware that your trustee, your creditors, the Office of the Superintendent of Bankruptcy or the Court can oppose or delay your bankruptcy discharge. Depending on your situation, you may need to attend a hearing, answer questions under oath and/or meet the additional requirements to obtain your discharge.

Your Credit Report & Bankruptcy in Canada

Legally eliminating debt through bankruptcy seriously impacts your credit rating and makes it hard to obtain credit later. You need to show creditors why they should trust you enough to lend you money again. Not being able to renew your mortgage, get a loan or apply for a low interest rate credit card often impacts other financial plans and puts your life on hold.

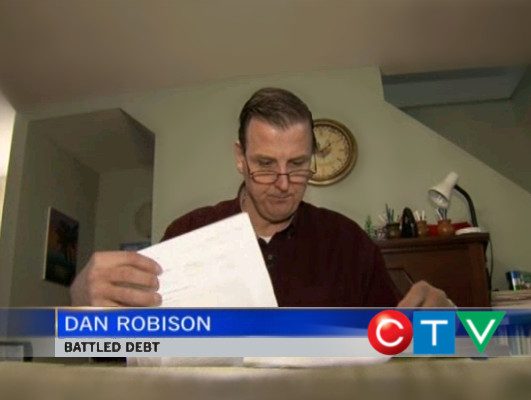

People We Helped Interviewed by the News Media

Occasionally, the news media will interview one or two Canadians we helped who are comfortable with publicly sharing their stories. Here are several of these experiences with the Credit Counselling Society.

CTV News reveals how Dan Robinson paid off $30,000 in debt with no interest with the help of the Credit Counselling Society. Watch the News Story

You can check out even more of the Credit Counselling Society in the news.

Alternatives to Bankruptcy in Canada

By now you are likely wondering what alternatives to bankruptcy really exist. There are quite a few, and combining them might also be a solution. Depending on your situation, 4 options that might work for you are: consolidation loans, debt repayment programs, debt settlement options or a Consumer Proposal.

Consolidation & Debt Repayment Programs

Consolidation usually means consolidating your bills and everything you owe into a new loan. With a fine-tuned budget, this might work for you. For other people, consolidating only the monthly payments makes more sense. Don’t worry if you’ve been turned down by your bank or credit union. There are other types of debt consolidation that may be available.

Consolidating payments doesn’t involve borrowing more money, so there’s never a problem with bad credit. That’s how a debt management program and plan with a non-profit credit counselling organization works. Creditors help by lowering or waiving interest charges while you’re making your payments. This lets you pay off your debts and saves you thousands in interest and fees. What you pay each month is based on what you can afford after you’ve had help to create a realistic personal budget.

Settle Debt

Consolidation programs and loans help you repay what you borrowed. Most people really do want to pay back what they owe and not walk away from their debts by declaring bankruptcy. However, only paying back part of what you owe might be the best solution. That’s where a debt settlement, when structured properly, can help. You need a lump sum of money to offer your creditors a settlement, but sometimes that’s not as far-fetched an option as you might think.

Filing a Consumer Proposal

Sometimes a legal alternative to bankruptcy might be what you need. A Consumer Proposal could be the right solution depending on your situation. A Consumer Proposal in Canada is arranged by a trustee, and by making monthly payments, you pay back part of what you owe. Your creditors have the option to agree to the proposal or not.

What’s My Best Option?

As you can tell, a lot depends on your situation. When you’re just trying to make ends meet and duck the collection phone calls, you need help looking at your circumstances objectively. You need a professionally trained Credit & Debt Counsellor to help you come up with a good plan.

Discover Your Options

A Visual Overview of Possible Options

Here are some options that may be available to you based on the information you have provided about your financial situation. The most likely options are in green, less likely in yellow, and least likely in red. This is only intended to provide you with a general idea of the options that may be available to you. A credit counsellor will need to go over your information in much more detail to make a more precise determination.0

Option

Do a Deeper Dive to Uncover More Options

It looks as though your situation requires more in-depth analysis from a trained credit counsellor. They can help you optimize your budget, explore options, and create a plan to get back on track.

0

Option

Self-Managed Solution

After thoroughly exploring your options with a credit counsellor, they can help you put together a plan to get out of debt in a reasonable amount of time. You can then implement this plan on your own.

0

Option

Debt Consolidation Loan

Based on the information you've provided, it appears as though this could be a possibility if your credit score is strong enough.

0

Option

![]()

Debt Management Program

It appears as though this may be an option for you. A Debt Management Program eliminates or drastically reduces interest and consolidates all payments into one.

0

Option

![]()

Consumer Proposal

This may be an option for you to consider. It's a legal process that consolidates all payments into one. Talk to a credit counsellor about this and see if it makes sense for your situation.

0

Option

Bankruptcy

Based on the information you've entered, it appears as though bankruptcy may be an option to resolve your financial challenges. You should speak with a credit counsellor about this and make sure you've exhausted all other options first.

0

Option

Orderly Payment of Debts

Based on what you've entered, it looks as though an Orderly Payment of Debts (OPD) program may be an option for you. To find out if this would make sense for your situation, you should speak with a credit counsellor.

0

Option

Voluntary Deposit

Based on the information you've provided, it looks as though a voluntary deposit program may be an option to address your debt situation.

0

Bonus Option

Online Workshops

Learn how to improve your financial situation, create a budget, make your dollars stretch further, and get out of debt with one of our many helpful online workshops we call webinars.

More Specifics on How We Can Help You

Get Help Today

Give us a call to speak with one of our credit counsellors at 1-888-527-8999, or if you'd like us to contact you instead, please fill out the form below.

I honestly didn’t know what to do

I’m so grateful for the help of The Credit Counselling Society. I honestly didn’t know what to do. I got myself in debt way more than I could handle. And it’s nice to know that I’m paying off my debt with their help rather than claiming bankruptcy. Thank you so much everybody that spoke with me at credit counselling.

Tammy

There’s Life Beyond Debt for Everyone

“I am likely going to be out of debt within a year – and that’s over a year ahead of the initial estimate! Best part of that is that because the Credit Counselling Society did it as a debt repayment arrangement, unlike bankruptcy, it will be much better on my credit rating – and as proof, when I applied for new cell and cable service in Vancouver, my rating has already improved such that I got new accounts without a limit or deposit!”

– Paul, Actual Client from Yelp

Non Profit Bankruptcy & Credit Counselling Information & Advice in Canada

If you want to find out why someone shouldn’t declare bankruptcy, get answers to your questions about joint debts or debts left over from a divorce, or learn more about alternatives to bankruptcy, one of our Credit & Debt Counsellors can help! They are experts in helping people with their debts and money, and they’d be happy to provide you with the information you need to make an informed decision about your financial future.

Your Counsellor will:

- Review all of your options to deal with your debts, including personal bankruptcy alternatives

- Show you how to manage your living costs and bills effectively

- Refer you to a bankruptcy trustee in Canada if filing for bankruptcy is a good option for you

- Answer your questions and explain what you need to know so that you can decide the best way to deal with your debts

Free, Confidential Credit Counselling Appointments for Canada

We specialize in helping people across Canada just like you deal with their debts in ways that work best for them. It really is possible to be debt free and look forward to a stable financial future. To learn more or to schedule a free, confidential consultation with one of our Debt Counsellors, contact us today at 1-888-527-8999, email us or chat with us online.

Putting Your Interests First

Our goal is to always put consumers first and look out for their best interests in everything we do. One way we do this is through transparency and accountability. We are held accountable to the most rigorous standards in our industry.

The Credit Counselling Society also helps those who are having difficulty with their payday loans – even online loans – in Canada.

Provinces we serve

BC Bankruptcy Alternatives | Alberta Bankruptcy Alternatives | Saskatchewan Bankruptcy Alternatives | Manitoba Bankruptcy Alternatives | Ontario Bankruptcy Alternatives | Quebec Bankruptcy Alternatives | Yukon Bankruptcy Alternatives | Northwest Territories Bankruptcy Alternatives | Nunavut Bankruptcy Alternatives

Was this page helpful?

Thanks for letting us know.