Georgetown, Ontario Credit Counselling Society

Free Debt and Credit Help

Credit Counselling Georgetown – Are debt problems causing you stress? Maybe you’re struggling to make your minimum payments. If financial problems are making it hard to sleep or causing difficulty with your relationships, let us help.

Canada’s Leading Provider of Non Profit Consumer Credit Counselling & Debt Solutions Services

We are a non-profit consumer credit and debt counselling service providing debt solutions and help to Georgetown. Our highly trained and professionally accredited Counsellors can help you explore all of your options and find the best solution. We can help you:

- Get your finances back on track and create a budget to manage your expenses

- Consolidate your debts in Georgetown into one affordable payment

- Stop creditor collection calls

- Save many thousands of dollars in interest

Discover Your Options

A Visual Overview of Possible Options

Here are some options that may be available to you based on the information you have provided about your financial situation. The most likely options are in green, less likely in yellow, and least likely in red. This is only intended to provide you with a general idea of the options that may be available to you. A credit counsellor will need to go over your information in much more detail to make a more precise determination.0

Option

Do a Deeper Dive to Uncover More Options

It looks as though your situation requires more in-depth analysis from a trained credit counsellor. They can help you optimize your budget, explore options, and create a plan to get back on track.

0

Option

Self-Managed Solution

After thoroughly exploring your options with a credit counsellor, they can help you put together a plan to get out of debt in a reasonable amount of time. You can then implement this plan on your own.

0

Option

Debt Consolidation Loan

Based on the information you've provided, it appears as though this could be a possibility if your credit score is strong enough.

0

Option

![]()

Debt Management Program

It appears as though this may be an option for you. A Debt Management Program eliminates or drastically reduces interest and consolidates all payments into one.

0

Option

![]()

Consumer Proposal

This may be an option for you to consider. It's a legal process that consolidates all payments into one. Talk to a credit counsellor about this and see if it makes sense for your situation.

0

Option

Bankruptcy

Based on the information you've entered, it appears as though bankruptcy may be an option to resolve your financial challenges. You should speak with a credit counsellor about this and make sure you've exhausted all other options first.

0

Option

Orderly Payment of Debts

Based on what you've entered, it looks as though an Orderly Payment of Debts (OPD) program may be an option for you. To find out if this would make sense for your situation, you should speak with a credit counsellor.

0

Option

Voluntary Deposit

Based on the information you've provided, it looks as though a voluntary deposit program may be an option to address your debt situation.

0

Bonus Option

Online Workshops

Learn how to improve your financial situation, create a budget, make your dollars stretch further, and get out of debt with one of our many helpful online workshops we call webinars.

More Specifics on How We Can Help You

Get Help Today

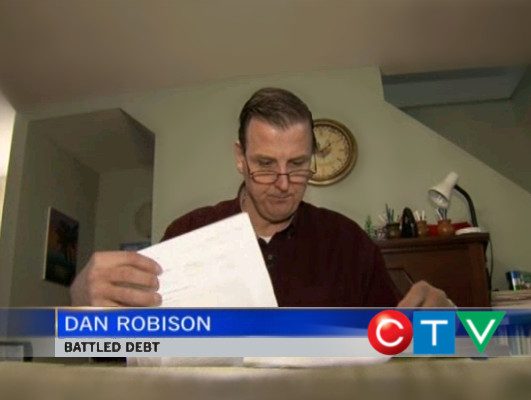

Give us a call to speak with one of our credit counsellors at 1-888-527-8999, or if you'd like us to contact you instead, please fill out the form below.People We’ve Helped Interviewed on CTV News and Global TV

From time to time, the news media interviews some of the people we helped who are comfortable sharing their story publicly. Below are three Canadians who shared their experience with the Credit Counselling Society.

You can see more of the Credit Counselling Society in the news.

Providing Canadians With Free Credit & Debt Counselling Services Since 1996

With

It’s Okay to Ask for Help with Debt

“Life just happened. My debt got to the point where I started to feel like I was drowning. I didn’t feel like I could fix it on my own, and I wanted to start living my life as an adult without debt. I decided to reach out for help. Feeling relieved, I knew that everything was going to be okay – a lot of work – but okay. I had a plan to pay back my debt and continue doing the things I love to do like yoga and travelling.”

– Yasmine

More About the Credit Counselling Society & Our Standards

We’ve provided non-profit credit counselling for over 27 years and usually give entirely free help to about 95% of those who reach out to us. People will only pay for our help if they make the decision to sign up for our Debt Management Program. This consolidates every one of someone’s credit card and other unsecured debt payments into just one monthly payment that fits their budget. With this program, interest is either stopped or substantially reduced. It will eliminate debt while protecting privacy, allowing credit repair, and working to put people’s finances back on the right track as soon as possible. Yet this is simply one of a variety of tools we have to assist people.

We firmly believe that the best debt consolidation and debt help is something that allows an individual or couple to accomplish their financial goals in the long-run while getting their finances back on track as fast as possible in the short-term. It’s disappointing that this perspective is at odds with how some commission driven credit consultants, financial counselors, debt advisors, and credit advisors who are out there choose to operate. We feel that when someone is having a hard time financially, it’s important to carefully consider all their options and figure out what’s going to work best for them in the long run. This is one important reason why we pay our staff a salary rather than commission. To hold our organization to the highest standards possible we have joined, been audited by, and are accountable to the National Foundation for Credit Counseling and Credit Counselling Canada. We’re also accountable to the Canada Revenue Agency, a volunteer board of directors and are the only organization in our industry to open up our books to an external auditor every year.

If you’d like one of our professionally trained counsellors to take a look at your situation and help you figure out what all your options are to get back on track, give us a call today at 1-888-527-8999. All you’ve got to lose is your debt.

The Credit Counselling Society also offers bankruptcy alternatives and information in Georgetown, Ontario.

Ensuring Your Interests are Always First

In everything we do, our goal is to always put the interests of consumers first and do what is best for them. Two important ways we pursue this is through transparency and accountability. We are held accountable to the highest and most demanding standards in our industry.