Help with Debt Problems in Ontario – Real Solutions That Really Work

Proven Ways to Manage, Fix, & Overcome Debt Problems in Ontario

Anyone in Ontario can experience debt problems, and the one thing most peoples’ debt problems have in common is the worry, major stress, and sleepless nights they cause. If you have a problem with debt, let us assist you in finding a solution so that you can put your worries to rest and sleep better at night knowing that you have a plan and a way to pay your bills.

How to Major Overcome Debt Problems in Ontario

When you are looking at how to overcome major debt problems in Ontario, the best course of action is to tackle them sooner rather than later. Simply hoping and waiting for things to improve will likely result in less options being available to you down the road.

You may have some idea about where to begin and what to do, but if you would like some help or guidance, please feel free to chat with us anonymously on our website or contact us by phone. We’d be happy to answer any questions you might have or help you make an appointment to talk with one of our professionally certified Credit Counsellors. Our appointments are always free, confidential, and without any obligation of any kind.

Our friendly, professional Credit & Debt Counsellors will help you get your finances back on track with a realistic plan that’s broken down into practical steps. Here is some of what they can help you with:

- Putting together a budget to handle all your debts and living expenses

- Showing you things you can do right now to begin resolving your debt problems

- Discussing options with you that can help you pay down your debts or look at alternatives to going bankrupt if you aren’t able to afford to repay all of the debt you owe

Serious Debt Problem Warning Signs

For some people, their situation improves and they’re able to manage to get back on track without anyone else helping them. However, if you have been wrestling with a debt issue for over a year, watch out for these warning signs. They might indicate that you may have a more serious debt problem.

To figure out if you need some assistance to get your debts back on track, ask yourself:

- Is debt stress making it more difficult to deal with everyday life?

- Do you notice that you are no longer getting ahead simply making minimum payments?

- Have you been declined for a debt consolidation loan?

- Do you depend on your credit cards, line of credit, or overdraft to make ends meet each month?

- Are you on the receiving end of collection calls or letters?

- Are you embarrassed to let others know about your financial situation?

- Are worries about money keeping you wake at night?

If you answered “yes” to any of these questions, then you probably need help to deal with your debt, eliminate it, and get your financial picture back on track. Call us and speak with one of our experienced Debt & Credit Counselors today.

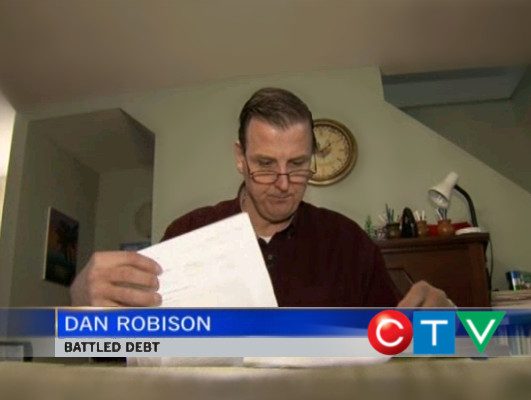

People We Helped Interviewed on Global TV and CTV News

From time to time, the news media interviews some of the people we helped who are comfortable sharing their story publicly. Below are three Canadians who shared their experience with the Credit Counselling Society.

Options and Solutions to Resolve Debt Problems

Worry over money and debt problems can make you sick from all the anxiety and stress. In addition to all this, we see many people coming to see us who are afraid about what may happen to them.

Walking you through options and solutions for your debt problems is part of how we can help you. We also take the time to answer any questions you might have about how to manage money, debt, and credit so that you can make informed choices about what to do and how to best deal with your debt problems.

Take the time now to contact the Credit Counselling Society by phone, email, or anonymous online chat to ask us the questions on your mind or to make an appointment to confidentially speak with one of our Credit Counsellors over the phone or in person.

Extra Information About How to Manage, Fix, and Overcome Debt Problems in Ontario

If you want to learn more on your own, here are popular topics that we get a lot of questions from Ontarians who are searching for solutions about how to manage, fix, and eliminate their debt problems.

- 12 Ways How to Get Out of Debt in Ontario

- How to Deal with Collection Calls and Demand Letters

- What to Do if You Get Turned Down for a Debt Consolidation Loan in Ontario

- Alternatives to Declaring Bankruptcy in Ontario

- Debt Management Plan

Give us a call at 1-888-527-8999. We would be happy to answer any questions you might have or refer you to an friendly, experienced professional who can provide you with the specific advice or solution you need.

Communities We Help in Ontario with Debt Problems

Brampton | Burlington | Etobicoke | Guelphtario | Hamilton | Kanata | Kingston | Kitchenertario | Leamington | Londontario | Markham | Mississauga | North Bay | Oakville | Oshawa | Ottawa | Pickering | Richmond Hill | Scarborough | Thunder Bay | Toronto | Vaughan | Whitby | Woodstock