Brandon, Manitoba Debt Consolidation

More than a Debt Consolidation Company – We Offer Objective Non-Profit Options & Advice

Have you been declined for a debt consolidation loan in Brandon by your bank or any consolidation companies you’ve spoken to? Are you struggling to keep up with your bills? Don’t let stress and worry get to you. We can help.

We’re Here to Help You Find the Right Option – Solutions for Problems Credit Cards, Debt Consolidation Loans, or Bad Credit

You can have one of our experienced, professionally certified counsellors walk you through all your options and help you find the solution that will work best for you—regardless of whether bruised credit, bad credit, maxed out credit cards or other issues have prevented you from getting a debt consolidation loan. As a non-profit organization, all of our debt consolidation advice is objective and completely tailored to your financial situation and priorities.

We Can Help You Get Your Finances Back on Track, Save Money and Pay Off Debt

Our counsellors can assist you right now by helping you put together a plan to:

- Figure out all your debt consolidation options and decide which will work best for you

- Consolidate your debt payments into one payment you can afford

- Save thousands in interest payments

- Create a spending plan and effectively manage your bills and regular living expenses

Discover Your Options

A Visual Overview of Possible Options

Here are some options that may be available to you based on the information you have provided about your financial situation. The most likely options are in green, less likely in yellow, and least likely in red. This is only intended to provide you with a general idea of the options that may be available to you. A credit counsellor will need to go over your information in much more detail to make a more precise determination.0

Option

Do a Deeper Dive to Uncover More Options

It looks as though your situation requires more in-depth analysis from a trained credit counsellor. They can help you optimize your budget, explore options, and create a plan to get back on track.

0

Option

Self-Managed Solution

After thoroughly exploring your options with a credit counsellor, they can help you put together a plan to get out of debt in a reasonable amount of time. You can then implement this plan on your own.

0

Option

Debt Consolidation Loan

Based on the information you've provided, it appears as though this could be a possibility if your credit score is strong enough.

0

Option

![]()

Debt Management Program

It appears as though this may be an option for you. A Debt Management Program eliminates or drastically reduces interest and consolidates all payments into one.

0

Option

![]()

Consumer Proposal

This may be an option for you to consider. It's a legal process that consolidates all payments into one. Talk to a credit counsellor about this and see if it makes sense for your situation.

0

Option

Bankruptcy

Based on the information you've entered, it appears as though bankruptcy may be an option to resolve your financial challenges. You should speak with a credit counsellor about this and make sure you've exhausted all other options first.

0

Option

Orderly Payment of Debts

Based on what you've entered, it looks as though an Orderly Payment of Debts (OPD) program may be an option for you. To find out if this would make sense for your situation, you should speak with a credit counsellor.

0

Option

Voluntary Deposit

Based on the information you've provided, it looks as though a voluntary deposit program may be an option to address your debt situation.

0

Bonus Option

Online Workshops

Learn how to improve your financial situation, create a budget, make your dollars stretch further, and get out of debt with one of our many helpful online workshops we call webinars.

More Specifics on How We Can Help You

Get Help Today

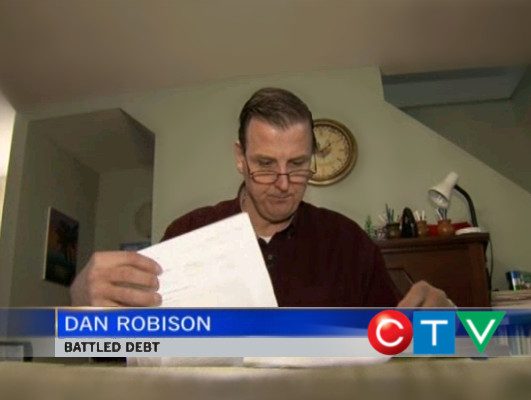

Give us a call to speak with one of our credit counsellors at 1-888-527-8999, or if you'd like us to contact you instead, please fill out the form below.Canadians We Helped Interviewed on the News

On occasion, the news media will talk to one or two of the people we helped who are comfortable sharing their story with the public. Below are three of these stories.

You can check out even more of the Credit Counselling Society in the news.

Offering the Best Not for Profit Consumer Debt Consolidation Programs & Interest Relief Plans to Brandon

As a non-profit service, the Credit Counselling Society has been helping people consolidate their debt payments and manage their finances more effectively since 1996. Our organization has helped hundreds of thousands of Canadians, and we’ve grown to become Canada’s largest credit and debt counselling service with local Counsellors in offices across much of Canada. We’ve earned the Better Business Bureau’s highest rating of accountability, won over 80 awards for exceptional service, and now 98% of our clients surveyed report they would recommend us to others.

Contact us to learn more or make an appointment with a counsellor. Our appointments are completely free, confidential, and non-judgmental. Call us now at 1-888-527-8999.

It’s Okay to Ask for Help with Debt

“Life just happened. My debt got to the point where I started to feel like I was drowning. I didn’t feel like I could fix it on my own, and I wanted to start living my life as an adult without debt. I decided to reach out for help. Feeling relieved, I knew that everything was going to be okay – a lot of work – but okay. I had a plan to pay back my debt and continue doing the things I love to do like yoga and travelling.”

– Yasmine

Find Out More About the Debt Consolidation Options that May Be Available to You

If you’re not prepared to speak with anyone yet about your situation, we have more resources you can use to look into all available debt consolidation loan options on your own.

When you are ready to talk with someone about your consolidated credit and repayment options in Brandon, you can speak with us by phone, email, online chat, or in person at one of our local offices.

We also help people who think they may need to go bankrupt explore all their alternatives to bankruptcy that are available in Brandon, Manitoba to see if there is another less drastic way to get out of debt and back on track.