How to Build New Year’s Goals & Plans

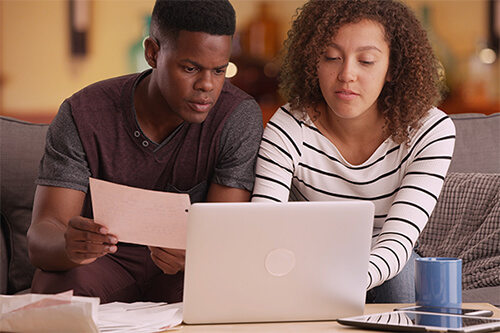

Q: Another year has gone by and my wife and I are frustrated that we can’t seem to get ahead financially. I have to admit that the thought of living ultra-frugally for the next 30 years so we can retire comfortably, is not very appealing. Where do we go from here?

A: The question you need to ask yourselves first is what’s really holding you back from getting your finances on track? Many people have the perception that managing money effectively and working towards financial goals, comes at too high a price: their lifestyle. As a result, they put off financial planning until the future which can have a disastrous impact on a person’s retirement.

Change comes at a price; you have to be prepared to sacrifice a little to get something in return, but it doesn’t mean that you have to give up everything today in order to retire comfortably in the future. Financial planning is not about going without. It’s all about making informed decisions, having patience and getting more out of what you have. Good financial planning also requires that we separate our wants from our needs.

Where do you go from here? The first step is setting aside some quiet time for you and your wife to evaluate your current financial picture. Next, we would encourage both of you to write down your answers to the following questions:

- What are your short, mid and long term financial goals?

- What changes are you prepared to make in order to achieve your goals?

Your goals need to be specific, realistic and with a set time line to achieve them. Once you have answered these questions, compare notes to see what goals and changes you have in common. Working together identify your top 4 or 5 goals and the changes you are prepared to make to turn these goals from wishful thinking into reality. You’re now ready to meet with a qualified financial planner, who will help you evaluate your goals and develop a plan to achieve them. The website www.investright.org can help you identify the right planner for your needs. Lean on each other as you work through this process; you’ll be each others’ pillar of strength. Think of your plan as a roadmap to where you want to be financially in the future.

Don’t let your “wants” get in the way of your goals. Mick Jagger said it best; you can’t always get what you want, but if you try sometimes, well you just might find you get what you need.

0 Comments