How Bankruptcy Works

Step 10: Rebuilding Credit After Brankruptcy

Life After Bankruptcy

Rebuild Credit for a Bright Financial Future

Other than debts excluded from your bankruptcy, after receiving your discharge, you are no longer legally obligated to repay the debts you owed when you filed for bankruptcy. If your debts were joint with someone, you declaring bankruptcy only means that you’re no longer legally responsible for what’s owed. The other person’s liability is not affected. This means that they still need to pay what’s owing. There are some things you need to know about credit after bankruptcy and how to build a bright financial future.

Rebuild and Fix Credit After Bankruptcy

Improve Your Credit Score or Credit Report

Creditors will know you filed for bankruptcy for at least 6 years.

There’s no quick way to “fix your credit” or erase the bankruptcy notation on your credit report. With a first bankruptcy, it will be there for at least 6 years from when you obtained your discharge, and longer for a second or third bankruptcy.

Note: This summary of the steps involved in the personal bankruptcy process is based on information from the Office of the Superintendent of Bankruptcy website.

Common Questions About Rebuilding Credit After Bankruptcy

Rebuild Credit After Bankruptcy – Manage Money and Stay Out of Debt

If you need more information about how to rebuild credit after bankruptcy you can contact us right now. One of our credit counsellors will answer your questions and provide you with guidance. If you’ve just gone through bankruptcy and need some emotional support and financial coaching, contact us for free credit counselling services. We will help you get back on track and show you how to manage money so you can avoid bankruptcy and financial trouble and keep it that way. You can have a bright financial future!

Related Articles

Related Topics

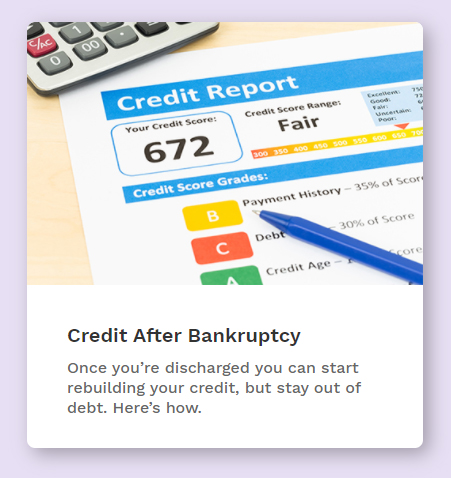

Credit After Bankruptcy

Once you’re discharged you can start rebuilding your credit, but stay out of debt. Here’s how.

What is Insolvency?

Insolvency in Canada is a legal last resort when you can no longer repay what you owe.

Options for Bankruptcy

Here are 6 times when filing bankruptcy might not be right for you. Know what to expect.