Objective, Debt Consolidation Options & Advice in Saskatchewan

We are More than a Debt Consolidation Company

Have you tried to get a debt consolidation loan in Saskatchewan but the bank and the consolidation companies you spoke to weren’t able to help? Don’t let stress and worry get you down. We can help you.

We’ll Work with You to Find the Right Option – Solutions for Problems with Debt Consolidation Loans, Bad Credit, or Credit Cards

You have options. One of our experienced, certified debt counsellors can help you take an objective look at your situation and show you the various options available to you—regardless of whether hitting your credit card limits, bad credit or other challenges have hindered you from finding a debt consolidation loan. They can then help you figure out the best choice: one which makes the most sense for your goals.

We Can Help You Get Your Finances Back on Track, Save Money and Pay Off Debt

Our experienced counsellors can help you get going right away with a solid plan to:

- Carefully look at all your debt consolidation options to address your debt and get your finances back on track

- Effectively handle your bills and living expenses

- Repay your debts with one manageable monthly payment

- Save yourself thousands in interest charges

Discover Your Options

A Visual Overview of Possible Options

Here are some options that may be available to you based on the information you have provided about your financial situation. The most likely options are in green, less likely in yellow, and least likely in red. This is only intended to provide you with a general idea of the options that may be available to you. A credit counsellor will need to go over your information in much more detail to make a more precise determination.0

Option

Do a Deeper Dive to Uncover More Options

It looks as though your situation requires more in-depth analysis from a trained credit counsellor. They can help you optimize your budget, explore options, and create a plan to get back on track.

0

Option

Self-Managed Solution

After thoroughly exploring your options with a credit counsellor, they can help you put together a plan to get out of debt in a reasonable amount of time. You can then implement this plan on your own.

0

Option

Debt Consolidation Loan

Based on the information you've provided, it appears as though this could be a possibility if your credit score is strong enough.

0

Option

![]()

Debt Management Program

It appears as though this may be an option for you. A Debt Management Program eliminates or drastically reduces interest and consolidates all payments into one.

0

Option

![]()

Consumer Proposal

This may be an option for you to consider. It's a legal process that consolidates all payments into one. Talk to a credit counsellor about this and see if it makes sense for your situation.

0

Option

Bankruptcy

Based on the information you've entered, it appears as though bankruptcy may be an option to resolve your financial challenges. You should speak with a credit counsellor about this and make sure you've exhausted all other options first.

0

Option

Orderly Payment of Debts

Based on what you've entered, it looks as though an Orderly Payment of Debts (OPD) program may be an option for you. To find out if this would make sense for your situation, you should speak with a credit counsellor.

0

Option

Voluntary Deposit

Based on the information you've provided, it looks as though a voluntary deposit program may be an option to address your debt situation.

0

Bonus Option

Online Workshops

Learn how to improve your financial situation, create a budget, make your dollars stretch further, and get out of debt with one of our many helpful online workshops we call webinars.

More Specifics on How We Can Help You

Get Help Today

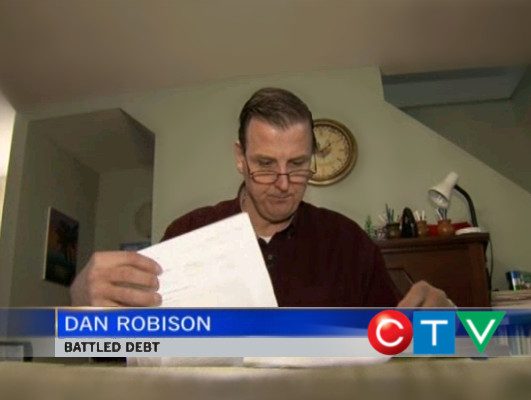

Give us a call to speak with one of our credit counsellors at 1-888-527-8999, or if you'd like us to contact you instead, please fill out the form below.Global TV and CTV News Interview People We Helped

Occasionally, the news media will speak with people we helped who are comfortable with publicly sharing their experiences. Here are a few of their stories.

You can check out even more of the Credit Counselling Society in the news.

Offering the Best Not for Profit Consumer Debt Consolidation Programs & Interest Relief Plans to Saskatchewan

As a registered non-profit organization, the Credit Counselling Society has been providing debt payment consolidation help and guidance to help people learn how to manage their debt and money better since 1996. Over this time, the society has earned the Better Business Bureau’s highest possible rating of A+ and has been designated as an Accredited organization.

Our unwavering commitment to provide Canadians with the best credit counselling and debt relief service has not only resulted in many awards for exceptional service, but more importantly 98% of our clients surveyed report they would recommend our services to family and friends.

Please call if you wish to learn more or want to set up an appointment with one of our counsellors. These appointments are completely free, non-judgmental, and confidential. Call us at 1-888-527-8999.

There’s Life Beyond Debt for Everyone

“When debts became a problem, I felt very overwhelmed – like I could not see the end of the tunnel. Picking up the phone felt like lifting a 10 pound rock, but they were very cheerful on the other end of the line. I came in, discussed my situation in privacy, and instantly got relief knowing I was in good hands.”

– Delores

Learn More About Debt Consolidation Options

If you would like to look into this some more before you talk to anyone, feel free to check out the 9 most common ways to consolidate debt in Canada.

When you’re ready to chat with us about your consolidated credit options in Saskatchewan, you can connect with us by phone, email, online chat, or in person at one of our many locations.

For individuals who believe they may need to file for bankruptcy, we help them review all bankruptcy alternatives and relevant information available in Saskatchewan to find another less drastic solution that will get their finances back on track.

Putting Your Interests First

Our goal is to always put consumers first and look out for their best interests in everything we do. One way we do this is through transparency and accountability. We are held accountable to the most rigorous standards in our industry.